Taking Care of Business, one business at a time

Taking Care of Business, one business at a time

Employee Embezzlement

What is it?

Fraudulent taking of personal property by someone to whom it was entrusted. Most often associated with the misappropriation of money. Embezzlement can occur regardless of whether the defendant keeps the personal property or transfers it to a third party.

How common is embezzlement?

According to the National White Collar Crime Center, it is estimated that employee theft and embezzlement cost businesses and organizations $400 billion per year. The FBI Financial Crimes Report to the Public estimates that financial crimes account for approximately thirty to fifty percent of all business failures.

A recent survey by the Association of Certified Fraud Examiners (ACFE) showed that over 70% of all employees take something from their employer, even if it is just a pencil or being paid for handling a personal matter while at work. Some are convinced to continue because of ease to commit the act and even escalate to items of larger value.

How can it be prevented?

First, doing nothing or living on trust is simply not the answer. People change, not just in appearance, but also ethically and morally. For this reason, proper controls need to be in place to minimize risks of embezzlement loss, also called occupational theft.

Size does matter! The smaller the company, the more likely it is to be victimized by employee embezzlement. Why? The short answer is because the smaller companies have less employees and are more trusting of the employees they have. Many of the internal controls that prevent and detect embezzlement require multiple employee involvement. However, there are steps that can be taken to minimize risks in small companies. There are some costs, but not always and not always significant. Any money spent to minimize embezzlement will save companies from the costs of loss, business disruption and potential reputation risk. There is no silver bullet that guarantees no embezzlement. However, leaving opportunities out there invites employees without morals and/or with decaying morals to steal from their employers.

Doing background checks are a common preventive technique. However, these only provide history on potential employee. It does nothing to predict moral character and how that person may react to changes that life brings their way. These folks may experience many life challenges for the first time while employed with your company. These challenges could be experiences such as divorce, loss of spouse's job, financial needs of kids or grandkids, medical emergencies or other life changing events. You may never realize some of these challenges even exist. So, it's important to minimize your risks.

This is where our firm can help prevent the very frauds we have been called on to investigate. We have no desire to see our clients suffer like we have witnessed. These controls will most definitely reduce losses.

Cleaning Up the Embezzlement

Many, if not most, companies choose to not take protective measures.because they "trust" certain key employees. "Ole Bud or Suzy has been with us 15 years as a reliable employee." Maybe so, but the ACFE Embezzlement Study points out that the longer tenure, the larger the fraud/embezzlement. As a small company, there is more likely to be fraud and the longer the tenure, the larger the loss. This is very consistent with what we see when investigating the embezzlement.

After our investigation, we point out what went wrong and how the culprit misallocated assets. Then, our client typically implements changes generally equivalent to what we could have done that would have prevented or minimized their losses.

We will issue a report and assist the client with the case against the culprit. However, many times the client prefers to negotiate an agreement to get paid for some of the losses in exchange for not prosecuting. This can be effective up to the point the statue of limitations runs out. At this point, it is unlikely that the culprit will continue to pay. Finally, many companies have no intent for these cases to be open to the public as they will be during a criminal or civil court case. The client feels some sense of responsibility and wants closure. Keeping the embezzlement matters private will likely allow the culprit freedom to move on to the next victim company, because a background check would not give the new company reason to not hire. Giving the new company a bad employment reference would be the only chance to stop the spread of the bad actor.'s embezzlement habits.

ACFE Embezzlement/Occupational Fraud Study

The next section below are some highlights from the 10th Edition of the ACFE Embezzlement Study that can be found at this link in its entirety. Much of the information has been shared above.

Audio Versions of Embezzlement Schemes

In the last section of this page, we have shared some real embezzlement schemes as described in audio files shared with us by the ACFE. We would love to help your company avoid or discover issues before they worsen.

10th Edition of ACFE Embezzlement Study

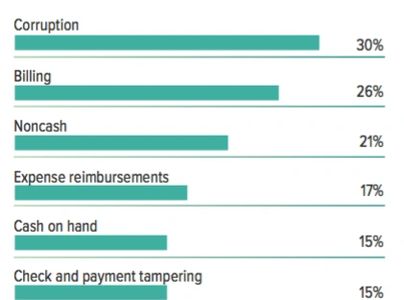

Most Common Embezzlements in US

Corruption, Billing, Non-cash and Expense Reimbursements make up 84% of all embezzlements in the US.

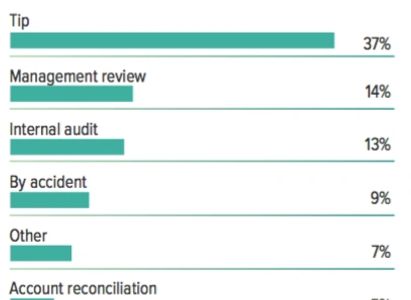

Most Common Embezzlement Detection in US

Internal or external tips, management review and internal audit leads to embezzlement detection in 64% of all cases.

Fraud Controls Found in Victim Companies

Approximately 50% of victim companies had these controls in place.

Company Size Matters

Unfortunately, smaller companies have more risk to be victim of embezzlement and the loss amount. This is why loss prevention is so important for smaller companies who can not afford such losses.

Bookkeeper Fraud

This ACFE audio file illustrates that small companies are more vulnerable to larger frauds. Even non-profits are not immune from fraud. Less staff means more opportunities for fraud.

Banker on the Run Fraud

Banking is a trusted profession. This fraud illustrates why you must not totally trust anyone. This came from the ACFE fraud file.

Copyright © 2022 Danny F. Dukes and Associates, LLC - All Rights Reserved.